18 Books That Sharpen Thinking And Strengthen Financial Habits

Financial confidence rarely appears overnight. For many people, it grows slowly through new perspectives, smarter habits, and lessons gathered one page at a time.

Certain books stand out because they do more than explain money; they reshape the way readers think about decisions, risk, discipline, and long-term goals.

Some challenge deeply held beliefs about success, while others offer practical frameworks that make complex financial ideas feel approachable and actionable.

Turning those pages often feels like having a thoughtful mentor guiding each step toward clearer thinking and stronger everyday choices.

Along the way, readers begin noticing patterns in spending, saving, and planning that once went overlooked.

Disclaimer: This article reflects editorial opinion on books the editor believes offer valuable perspectives on financial thinking and habits; selections are subjective and provided for general informational and entertainment purposes, not financial or professional advice.

1. Thinking, Fast and Slow by Daniel Kahneman

Ever wonder why you buy stuff you don’t need or panic-sell investments at the worst time?

Kahneman breaks down two mental systems: one that reacts fast and emotional, another that thinks slow and logical.

His research reveals cognitive biases that mess with spending, saving, and investing decisions.

Understanding these mental shortcuts helps you catch yourself before making expensive mistakes.

Though dense at times, this Nobel Prize winner’s insights change how you approach every financial choice moving forward.

2. The Psychology of Money by Morgan Housel

Formulas and spreadsheets won’t make you wealthy if your behavior sabotages every plan.

Housel writes short, punchy chapters about how emotions, patience, and mindset shape financial outcomes way more than math skills.

Stories about lottery winners going broke and janitors retiring as millionaires prove that discipline beats income every time.

His writing feels like chatting with a wise friend rather than reading a textbook.

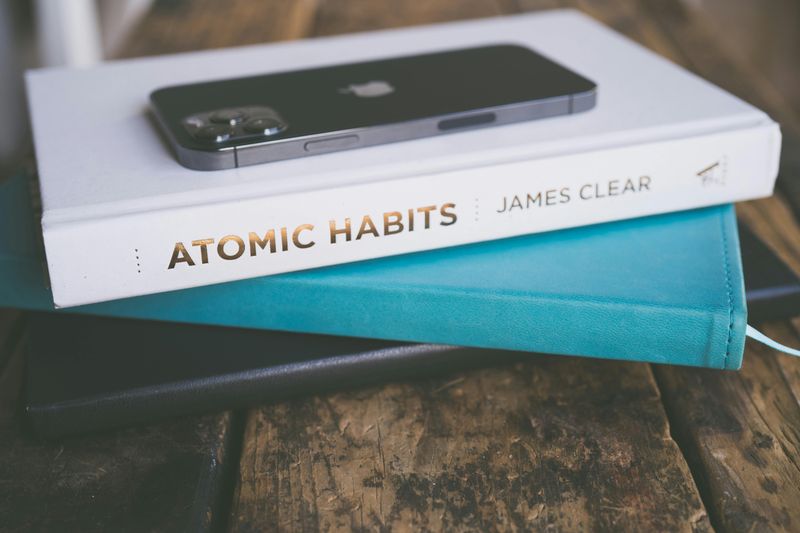

3. Atomic Habits by James Clear

Building wealth isn’t about one huge win but tiny actions repeated forever.

Tiny upgrades, repeated consistently, can snowball into surprisingly big outcomes, whether the goal is growing savings bit by bit or steadily strengthening an investment portfolio.

Clear’s framework for habit stacking, environment design, and identity shifts applies perfectly to budgeting and consistent saving.

Bonus: the strategies work for homework, exercise, and basically any goal requiring consistency over intensity.

4. Your Money or Your Life by Vicki Robin and Joe Dominguez

What if every dollar represents hours of your actual life?

A fresh perspective emerges as money becomes tied to time and personal energy, with Robin and Dominguez encouraging readers to rethink what every purchase truly costs beyond the price tag.

Their nine-step program encourages tracking spending, calculating real hourly wage, and aligning expenses with values.

Suddenly that overpriced gadget feels less appealing when you realize it cost twelve hours of work.

5. The Millionaire Next Door by Thomas J. Stanley and William D. Danko

Spoiler alert: most millionaires don’t drive Ferraris or live in mansions.

Years of research into the habits of real millionaires led Stanley and Danko to a clear conclusion: lasting wealth tends to grow from frugality and disciplined choices.

Their data shows millionaires buy used cars, budget carefully, and invest consistently rather than showing off. The research destroys myths about needing a six-figure income to accumulate serious wealth.

Reading this feels like getting secret intel on how regular people quietly become rich without anyone noticing.

6. Rich Dad Poor Dad by Robert T. Kiyosaki

Kiyosaki contrasts lessons from his educated biological father (poor dad) with his friend’s entrepreneurial father (rich dad), revealing totally different money philosophies.

One saw houses as assets; the other understood they’re often liabilities.

His concepts about cash flow, assets versus liabilities, and financial literacy challenge traditional school teachings.

Though some criticize his specifics, the core idea that financial education matters more than grades resonates deeply.

7. I Will Teach You to Be Rich by Ramit Sethi

This six-week program cuts through boring finance advice with automation systems that make saving and investing effortless.

Sethi’s approach focuses on conscious spending rather than deprivation, letting you enjoy lattes guilt-free while still building wealth.

Step-by-step instructions cover opening the right accounts, negotiating bills, and setting up automatic transfers that work while you sleep.

His tone feels like a smart older sibling giving real talk instead of lecture.

8. The Intelligent Investor by Benjamin Graham

Patience and risk management take center stage in Graham’s 1949 classic, long treated as a cornerstone of value investing and a counterpoint to get-rich-quick thinking.

His concept of Mr. Market (an emotional business partner offering daily prices) helps investors ignore short-term noise.

Though written decades ago, principles about buying undervalued companies and maintaining safety margins still work today. Warren Buffett calls it the best investing book ever written, which counts for something.

Fair warning: the language feels old-school, but the wisdom behind those words built countless fortunes.

9. A Random Walk Down Wall Street by Burton G. Malkiel

Malkiel argues that stock prices move randomly, making consistent market-beating nearly impossible for regular investors.

His solution? Low-cost index funds that track entire markets rather than picking individual stocks.

Data throughout the book shows how professional fund managers rarely beat simple index strategies after fees.

If you’ve ever stressed about choosing the perfect stocks, this book offers a simpler path with better odds.

10. The Simple Path to Wealth by J. L. Collins

What began as straightforward investing guidance written for his daughter ended up becoming something much bigger, with Collins helping spark a wider conversation around financial independence.

His philosophy boils down to: spend less than you earn, invest the difference in low-cost index funds, avoid debt.

No complicated strategies or fancy products, just straightforward guidance that anyone can follow regardless of income level.

Though he focuses heavily on Vanguard funds, the underlying principles apply universally for building wealth consistently.

11. Deep Work by Cal Newport

In a world built to fragment attention, Newport argues that sustained, distraction-free focus can create outsized advantages for both career growth and earning potential.

His strategies for eliminating distractions and scheduling deep work sessions boost productivity and skill development dramatically.

Better skills lead to higher earnings and more career leverage, making this indirectly a powerful money book.

In an age of constant notifications, mastering focus becomes a genuine superpower for financial success.

12. The Total Money Makeover by Dave Ramsey

Ramsey’s baby steps system provides crystal-clear instructions for escaping debt and building wealth through behavioral change.

His debt snowball method (paying smallest debts first) ignores math but leverages psychology for motivation.

Critics dislike his aggressive anti-credit stance, but millions credit his straightforward rules for transforming their finances.

His radio show energy translates into writing that feels like a coach pushing you toward financial fitness.

13. Mindset by Carol S. Dweck

Insights from fixed vs. growth mindset research help explain why some people keep going after financial setbacks while others stall out, framing persistence as a skill that can be developed rather than a trait you either have or don’t.

Believing abilities can improve through effort (growth mindset) creates resilience essential for long-term money success.

Her studies show how mindset affects learning, relationships, and career advancement, all of which impact earning potential.

Though not specifically about finance, this psychological framework strengthens the mental habits wealth requires.

14. The Barefoot Investor by Scott Pape

This book’s bucket system divides money into specific accounts for daily expenses, savings, and fun spending, creating automatic financial organization.

Simple rules like the 60/10/10/20 split make budgeting feel manageable rather than restrictive.

The writing style mixes humor with practical steps anyone can implement this weekend.

Where most finance books overwhelm with options, Pape just tells you exactly what to do next.

15. Principles: Life and Work by Ray Dalio

Instead of relying on gut instinct, Dalio emphasizes systematic decision-making principles – an approach he credits with helping him build one of the world’s largest hedge funds.

His frameworks for analyzing problems, seeking truth, and learning from mistakes apply brilliantly to financial planning.

Though his radical transparency approach feels extreme, the underlying logic about removing emotion from decisions improves investing and budgeting.

Fair warning: at 500+ pages, this requires commitment, but the mental models reward that investment.

16. Nudge by Richard H. Thaler and Cass R. Sunstein

Thaler and Sunstein explain how small environmental changes (nudges) dramatically improve decision-making without restricting freedom.

Their research shows how default options, framing, and choice architecture influence saving and spending behaviors.

Simple nudges like automatic enrollment in retirement plans or placing healthy food at eye level create better outcomes effortlessly.

This Nobel Prize-winning work proves that willpower alone fails, but smart systems succeed consistently.

17. The Richest Man in Babylon by George S. Clason

Using parables set in ancient Babylon, Clason frames money basics in a timeless way, presenting principles that have been shared for centuries and still feel practical now.

His core lesson about paying yourself first (saving before spending) forms the foundation of every successful wealth-building strategy.

Short, engaging stories about chariots and clay tablets make money lessons memorable rather than forgettable.

For those preferring and relating more to stories over spreadsheets, these ancient tales might deliver money wisdom surprisingly effectively.

18. Essentialism by Greg McKeown

Success can grow faster by narrowing the focus and doing fewer things with real excellence, McKeown argues, rather than diluting effort across every possible priority.

His framework for identifying what truly matters applies perfectly to financial goals and spending decisions.

Learning to say no to non-essential purchases and commitments frees resources for what genuinely improves your life.

In a world screaming buy everything and do everything, this book offers permission to focus selectively.